The Problem Today...

is that after 85 years of Keynesian Economics introduced by FDR & his crony stooges (Harry Hopkins: "We will spend and spend, tax and tax, elect and elect.") the system is now so severely distorted it functions about as well as an old crack ho.

The wild moves lately in oil & stawks are signals that the end is getting closer.

America once had an economic system linked to gold which was far steadier. Economic resets were frequent and served to flush out malinvestment and reward real economic innovation.

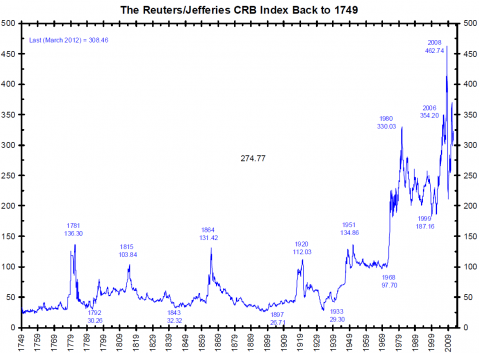

A review of CRB stats from 1750 to 1951 reveals Highs in

- 1781 of 136

- 1815 .. 103

- 1864 .. 131

- 1920 .. 112

- 1951 .. 135

The lows in this 200-year period ranged from 27 to 32.

After the high in 1951 the index only dropped back to 98 (in 1968), then climbed to 330 in 1980, dropping back to 187 in 1999, then 354 in 2006, dropped a little, then shot to 463 in 2008.

And where is it today? 163 .. http://stockcharts.com/h-sc/ui (Hit a low of 155 the 3rd week of JAN '16)

The system today is groaning under an ever increasing debt load (which only serves to prolong the inevitable reset and flush of malinvestments).

Web-surf graphs of the CRB and you will see these ever increasing & rising sine waves since Nixon abandoned the gold link to the dollar.

Our modern Keynesian Cargo Cultists are the direct cause of these increasingly wild perturbations.

Next time I will review the pricing of prime farmland in the USA and show the gyrations which began in the early 70s. Along with the gargantuan gyrations in oil pricing which also manifested in the early 70s.

Got Coins?

Streber out...